The Quick Guide to Bookkeeping for Small Businesses

Running a small business looks complicated from the outside, but from the inside, it’s even more complicated.

Managing personnel, crafting a unique value proposition, perfecting your products and services, complying with laws and regulations, and juggling paperwork are just some of the components that small businesses have to manage.

Bookkeeping is one of the most important tasks a small business must undertake because it lays the groundwork for every financial statement that underpins every business decision. Without small business bookkeeping, decision-makers are left with intuition and educated guesses—tools your business will quickly outgrow.

While small business bookkeeping can initially feel overwhelming, it isn’t an insurmountable obstacle. This guide will outline the essential principles and practices of bookkeeping for small businesses, along with some best practices for managing documentation.

Key Takeaways:

- Bookkeeping is day-to-day, while accounting is big-picture

- Bookkeepers use double-entry accounting to keep the accounting equation in balance.

- FileCenter enables document management for small business bookkeepers.

Defining Bookkeeping

Before you can master bookkeeping, you first have to understand what it is.

Bookkeeping and accounting go hand in hand, but they aren’t identical. Accounting is a broader discipline that encompasses recording and interpreting financial accounts at every level of the organization. Accountants journalize transactions, post them to the general ledger, and use that data to prepare financial documents.

Bookkeeping is a slightly narrower definition. Bookkeepers do the day-to-day work of recording transactions and creating limited reports but typically hand that data off to accountants who analyze that data to find long-term insights and create reports with larger scopes.

These definitions are not set in stone—the distinction between bookkeeping and accounting differs in every organization. The common understanding is that bookkeepers are responsible for day-to-day recordkeeping, while accountants are responsible for big-picture reporting.

At larger businesses, bookkeepers prepare records up to the trial balance, and accountants create financial reports from there. In smaller businesses, bookkeepers will have more overlap with accounting. At the smallest businesses, the same individual (sometimes even the owner) performs all bookkeeping and accounting activities. From manufacturing to consulting to retail to finance, every business in every industry uses bookkeeping.

Bookkeeping doesn’t look the same at every company, but the principles stay the same: bookkeepers record day-to-day transactions and prepare financial reports for managers and accountants.

Core Principles for Small Business Bookkeeping

While it’s important to know that the fundamental definition of bookkeeping is recording financial transactions, several core principles govern how bookkeepers should record those transactions.

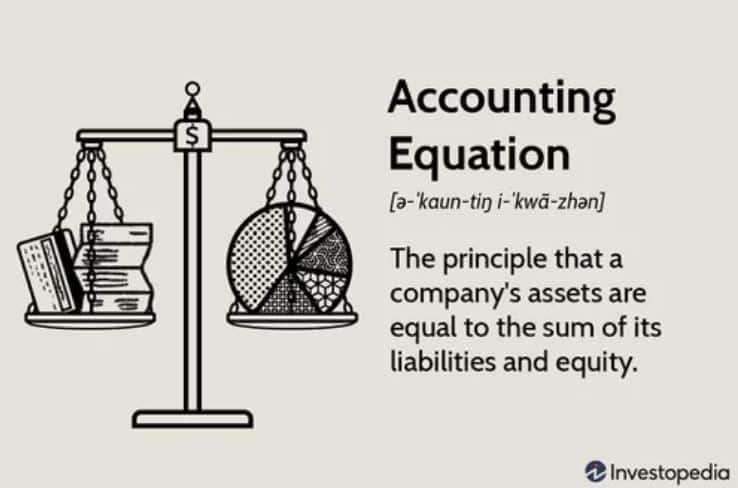

1. The Accounting Equation

The most basic question that bookkeepers and accountants answer is: how much money do I have?

In a cash-only world, answering that question would be as easy as opening your wallet and counting the bills, but things are more complicated in today’s business world.

Bookkeepers use three main categories to measure a company’s finances: assets, liabilities, and equity.

- Assets are resources the company owns. Cash is an asset, along with money in bank accounts, equipment, land, supplies, etc.—things most people would typically associate with the word “asset.” Less intuitively, things like accounts receivable are also assets because they represent a resource the company is entitled to.

- Liabilities are the flipside of assets: things the company owes to others. Liabilities include accounts payable, salaries payable, notes payable, interest payable, and unearned revenue (things your customers have paid you for but have not yet received).

- Equity is the third piece of the puzzle. Have you ever wondered where the money comes from to pay stock dividends? How do owners withdraw money or resources from a company directly (not just from a paycheck)? That is a concept called equity, which is an owner’s financial stake in a company. Broadly speaking, owners (such as partners, stockholders, or sole proprietors) pay money into a company to receive a stake in the business, and when the company does well, their interest is worth more. When the company does poorly, its interest is worth less.

It isn’t important to understand every nuance of these principles, but it is important to understand the accounting equation:

Assets = Liabilities + Equity

The accounting equation must always balance, so when a company’s assets increase, there will always be a corresponding increase in a liability (for example, taking out a loan), an increase in equity (the owner’s stake in the company is worth more than it was before), or a decrease in another type of asset (for example, receiving payment on an account receivable is increasing the Cash asset but decreasing the Accounts Receivable asset by an equal amount).

2. Double-Entry Accounting

Businesses don’t need to use double-entry accounting. However, it is the industry standard, and for good reason: double-entry accounting provides the clearest way of recording the flow of resources and keeping accounts reconciled in real time.

The fundamental idea behind double-entry accounting is that every transaction has two parts: bookkeepers debit resources from one account and credit them to another. For example, paying off an account payable would involve crediting the Cash account (recording where the money is coming from) and debiting the Accounts Payable account (recording where the money is going to).

Fully understanding the terms “debit” and “credit” in the accounting context is outside the scope of this guide to bookkeeping. Still, a good rule of thumb is that debits generally increase assets (on the left side of the accounting equation). In contrast, credits generally increase liabilities and equity (on the right side of the accounting equation), while the reverse is true for decreases.

Documents Used in Bookkeeping

Bookkeepers must correctly interpret and record various documents, including invoices, receipts, orders, paystubs, and more.

- Invoices list goods and services. When you think about day-to-day of business, you realize that goods and services go both ways: you both provide and receive goods and services. In the bookkeeping context, the word “invoice” means the document issued BY your company TO your customers.

- Bills are the flipside of invoices. Your company issues invoices to customers and receives bills from vendors/suppliers to your company.

- Receipts confirm a financial transaction, such as a vendor receiving payment.

- Purchase Orders record materials ordered by your company from external vendors. Bookkeepers don’t create purchase orders—that typically falls to a department manager—but bookkeepers do use purchase orders to verify bills before they pay them.

These are just a few of the documents bookkeepers use daily. Bookkeeping involves recording information from the entire company, from timecards to petty cash.

FileCenter’s Document Management Solutions

With all these documents, where should bookkeepers start?

The best place to start is to have a plan for managing your documents, both physical and digital. Increasingly, business occurs digitally and remotely, and it’s paramount that companies be able to make sense of their digital documents and store them securely.

FileCenter is a robust document management software that helps companies like yours record, process, store, and access their vital digital documents.

With various tools like OCR, content-based routing, and a secure sharing portal, FileCenter is a powerful asset for companies of every size.

To learn how FileCenter can enable your bookkeeping by managing your digital documents, download a free trial or schedule a demo today.